How to Develop a BNPL App Like Klarna UK? A Complete Guide

Buy Now Pay Later (BNPL) is one of the latest market trends, growing at an exponential rate among online shoppers. But how do these apps work? Well, that’s easy to answer! These BNPL service apps work exactly like credit cards by giving you a monthly spending limit to purchase your desired product now and pay for it next month or in installments. The best part is that no interest is charged on BNPL transactions. This is probably the reason why these apps are getting immersed in popularity, especially in the UK. We have used a lot of BNPL apps, but Klarna UK was the one that grabbed our attention and for good reasons.

Considering the user’s online review, Klaran UK seems to be one of the reliable financial services apps, offering multiple BNPL options like direct payment, lumpsum payment next month, pay on delivery, and installment options. Another interesting thing we discovered about the Klarna UK app was it offers two different versions: one for shoppers and another for businesses, with features like

- Pay with flexibility

- Snooze payment

- Easy payment handling

- Purchase Pharmacy

- Safe payment mechanism

- Paperless payments

Klarna is probably the best example of a BNPL app and probably the best inspiration for businesses planning to have an app like that. One more thing to note here is that the app’s active users surpass 150 million. The popularity of Klarna UK underscores the opportunities for BPNL apps in the region. So, it is high time to invest in BPNL mobile app development. And if you’re thinking so, an app like Klarna is a perfect reference.

This blog cum guide will walk you through the entire process of the BNPL mobile app development process, along with giving you average cost estimations and also delivering an honest verdict on whether it is profitable to invest in it. So, let’s get started!

What Is Klarna UK?

Klarna App was launhe in 2005 by a Swedish bank, Klarna Bank AB. Initially, it was nothing more than a Swedish version of PayPal. Later, in 2016, when the BNPL services were integrated into the app, its popularity skyrocketed, inspiring financial services providers to go online.

With continuous improvements and enhancements in the Klarna UK app, it has been generating good revenues. The number of Klarna UK users surpassed 18 million, with at least 31,000 merchants.

As said earlier, the Klarna app has two variants – one for Shoppers and another for business. The services of Klarna shopper apps include

- Pay with flexibility

- Pay in 4 interest-free installments.

- No impact on credit score

At the same time, the Klarna app has also been helping businesses to grow, with over 31,000 merchants using the services in the UK alone. The services of the Klarna business app include

- Elevated customer experience

- Seller protection

- Easy business insight

- Marketing Solutions

How Profitable is the BNPL App Development?

If you’re reading this blog, the chances are that you have already considered developing a “buy now, pay later” (BNPL) app like Klarna UK. If you’re still in doubt, here are some additional reasons why investing in BNPL mobile app development is a decision you will never regret.

According to ResearchAndMarkets.com, the global BNPL market is projected to expand from $9.2 billion in 2022 to a staggering $68.433 billion by 2030, growing at a compound annual growth rate (CAGR) of 28.47%.

Statista reports that the BNPL option is predominantly used in Northwestern Europe, Australia, and New Zealand. However, it’s not just limited to these regions. BPNL services like Klarna are quite popular in the US, with youngsters taking advantage of them.

The COVID-19 pandemic has further boosted the use of BNPL apps as more consumers have shifted to online shopping due to lockdowns and social distancing protocols. But that’s not the only reason to invest in BNPL app development.

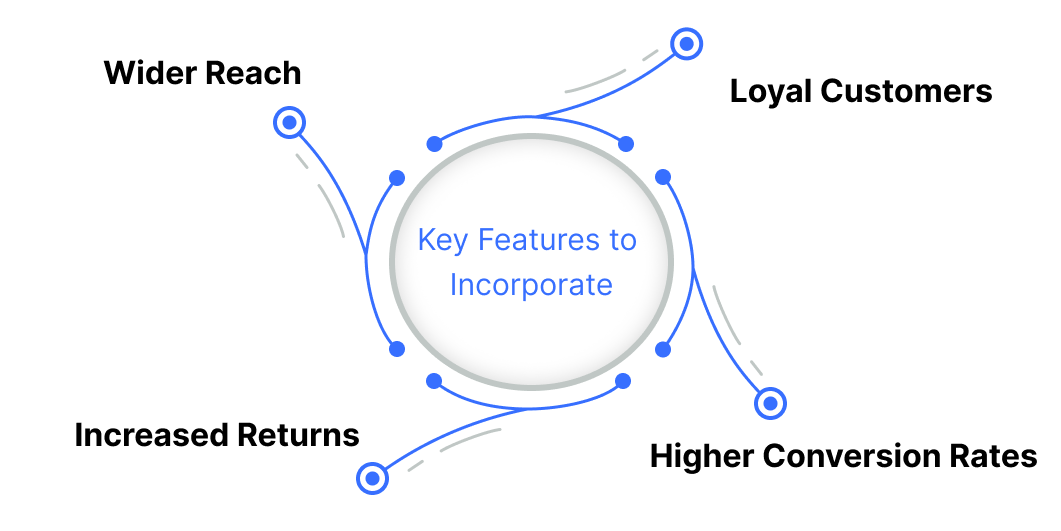

Wider Reach

The BNPL model has become increasingly popular in recent years, particularly among younger consumers seeking more flexible payment options. This suggests that the demand for these apps will continue to grow, potentially making them a profitable investment. You could reach a broader audience and even promote your other services/products more effectively.

Increased Returns

With the rising popularity of BNPL apps, there’s potential for high returns for investors. These apps usually charge fees or interest on their loans, which can generate substantial revenue for the business.

Loyal Customers

Users of BNPL apps tend to make repeat purchases frequently. They might shop as often as 20 times a year with the right discounts and rewards. Once you acquire users for your app, there’s a high likelihood that they’ll stick around and become valuable customers for your business.

Higher Conversion Rates

Trusted sources suggest that investing in BNPL app development could increase businesses’ revenues by 20% to 30%. As a result, an increasing number of companies are opting to develop an app like Klarna UK instead of offering credit cards.

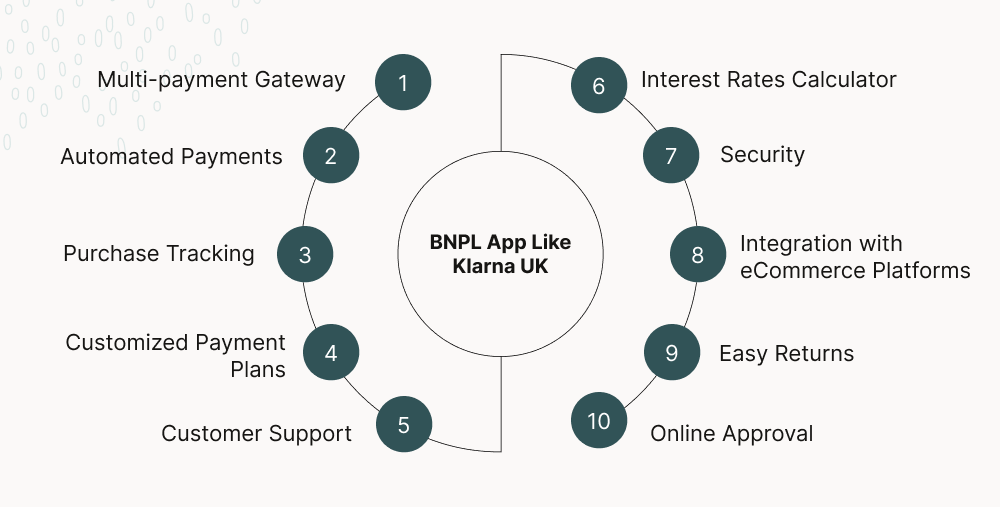

Key Features to Incorporate in the BNPL App Like Klarna UK

Feature integration is the most crucial aspect of the entire mobile app development process. It can make or break your success. While BNPL apps have many features, we have listed some of the most crucial ones. However, you can integrate more features as needed by the user.

So, here are some core features of a BPNL app:

Multi-payment Gateway

It’s essential to provide your users with a variety of easy and flexible payment methods. These could include options like credit cards, bank transfers, and digital wallets, simplifying bill payments.

Consider offering short-term loan options that can be repaid within days or weeks, as well as long-term loan options that extend over a year or two.

Automated Payments

Give your users the convenience of setting up automatic payments. This ensures they never miss a payment and avoid late fees. Use push notifications to remind them about upcoming deals, pending payments, and remaining installments.

Purchase Tracking

Implement data analytics tools to monitor your users’ spending habits. Also, empower your users to keep track of their purchases, payments made, and outstanding amounts.

Customized Payment Plans

Allow your app users to adjust their payment schedules based on their buying habits, expenditure on specific items, and past transactions. You could also provide them with tailored plans for repayments on a monthly, quarterly, or yearly basis.

Customer Support

The trend of using AI-powered chatbots for customer support operations is on the rise. Many companies are utilizing AI development services to integrate advanced chatbots into their mobile apps. Therefore, consider incorporating a custom chatbot into your ‘buy now, pay later’ app, similar to Klarna.

This will enhance customer support, provide round-the-clock assistance, and improve the overall customer experience. You could also use Natural Language Processing (NLP) and conversational AI services to make your chatbot more human-like in its interactions.

Interest Rates Calculator

Your “Buy Now, Pay Later” (BNPL) app should have an interest rates calculator, enabling users to comprehend the total expense of their purchases. Consider offering enticing rewards for larger purchases and loyalty vouchers for spending above a specific limit. This strategy can attract new users and retain existing ones.

Security

As BNPL apps store sensitive user data, including banking details, personal information, and payment passwords, it’s crucial to implement robust security measures. Utilize security models and tools to protect this information from cyber thefts and fraud.

Ensure your custom BNPL app employs secure encryption and authentication protocols to safeguard users’ personal and financial data.

Integration with eCommerce Platforms

Your app should be compatible with a broad spectrum of retailers and online eCommerce platforms, allowing users to shop from their preferred stores using your app.

You could also provide intelligent recommendations based on ongoing deals at certain stores, ensuring users get all these offers and increasing the likelihood of them making payments through your app.

Easy Returns

Ensure you provide immediate refunds to your customers when they cancel their purchases or choose to pay in full instead of using your app for payments. This approach will enhance the credibility of your BNPL app, attracting a more valuable global audience.

Online Approval

One of the main drawbacks of traditional loan methods is the extensive paperwork and lengthy approval times. However, this isn’t the case with the “Buy Now, Pay Later” model. Therefore, provide your users with online document submission facilities, enabling them to upload their documents online and receive instant payment approvals.

Tech Stack Required for Buy Now Pay Later App Development

Have you ever wondered what’s fueling the success of mobile apps? It’s the latest technological advancements and use of advanced tech stack that help keep apps like Klarna updated. Developing a BNPL app like Klarna requires you to understand the various app development technologies, frameworks, and API integrations.

- Payment Gateway APIs: You can integrate popular third-party APIs, such as PayPal, Braintree, and Stripe, to facilitate online payments.

- Credit Check APIs: You can integrate credit check APIs like Equifax or Experian to allow your buyers to check and verify their credit scores.

- Banking APIs: Use banking APi like Plaid to allow users to seamlessly link their bank account for instant fund transfers.

- Fraud Detection APIs: Fraud in financial apps is common. However, you can lower the risk of fraud by using the fraud detection APIs like Simility or Sift.

- Identity Verification APIs: To identify the user verification on the app, you can use third-party API service providers like Onfido, Jumio, and Veriff.

- Cloud Hosting: You can use cloud hosting API services like Azure, AWS, or Google Cloud to manage user data and ensure high scalability.

- Security Protocols: SSL encryption, firewalls, and two-factor authentications are essential for protecting user data and privacy.

- Machine Learning Algorithms: You can integrate machine learning algorithms for insightful data analysis and provide personalized credit offers based on it.

- Al Chatbot Tools: Customer services are a must for BNPL services. For apps like Klarna, you should integrate AI chatbot tools like TensoreFlow, PyTourch, and NLP models.

Here’s a quick table highlighting the essential technologies required for your BNPL app development:

|

Platform |

Tech Stack, Tools, and Frameworks |

|

Native App Development |

Kotlin, Objective C, Swift |

|

Hybrid App Development |

React Native and Flutter |

|

Frontend |

Angular Or React JS, Typescript |

|

Backend |

Java, Python, .NET, Node.js |

|

Cloud and DevOps |

AWS, Azure, Google Cloud, Docker, Kubernetes |

|

CMS |

Strapi, Storyblok, Contentful |

|

Analytics |

MixPanel, Google Analytics |

|

Database |

MongoDB, PostgreSQL, or MySQL for data storage. |

|

Code Review and CI/CD |

SonarQube, Codemagic, Gitlab, GitHub, BitBucket |

|

Payment Gateway |

Stripe, Braintree, PayPal, Razorpay |

|

AI Tools |

Generative AI, OpenAI, Large Language Models, Machine Learning |

|

Notifications |

Firebase, One Signal |

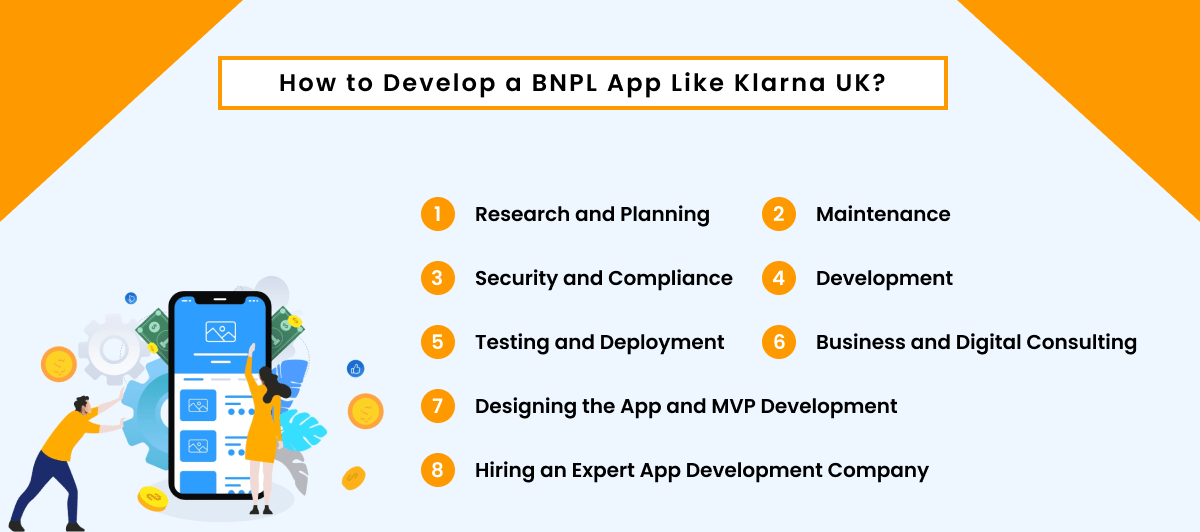

How to Develop a BNPL App Like Klarna UK?

There are some crucial steps to follow when developing a BNPL app like Klarna. You might need different panels for your app: user panel, retailer panel, and admin panel.

The user panel is for users where they can leverage your services, take credit and even shop with it. The business or merchant panel is for businesses to help them manage their profile. At the same time, admin panels give you complete control of your profile.

Here’s how you can develop an app like Klarna:

Step 1. Research and Planning

To create a successful “Buy Now Pay Later” (BNPL) app similar to Klarna, the first step is to gather information about your targeted audience, recognize market trends, and scrutinize your competition. You need to establish the goals of your app, which could be to offer a new payment method or to stand out with a distinctive BNPL service.

This understanding will direct the integration of features and operations. Crucial questions about identifying your target users, their advantages from the BNPL app, prevalent apps in the market, potential revenue models, and necessary resources are vital in shaping an effective app development strategy.

Moreover, exhaustive market study and competitor evaluation are vital to identify unique attributes that can distinguish your app. Using these findings, devise a detailed plan that outlines the app’s goals, features, and target users. This strategic method guarantees enhanced brand worth, user-focused app development, and contented customers.

Step 2. Business and Digital Consulting

The next step is to leverage the digital advisory services. Given the industry’s ever-changing nature, even with a basic understanding of the app development market, there could be unknown trends and tools. This is where the expert advice can help you.

Professionals with extensive experience developing similar apps for diverse businesses can provide valuable guidance through digital consulting services. Well-established companies globally specialize in comprehending the real challenges of your business and customers, recognizing the latest trends in your field, and offering customized solutions that meet your specific needs.

For instance, the “shop now, pay later” concept is applied in various industries beyond eCommerce. Furthermore, the integration of AI, data analytics, and predictive analytics can significantly boost your app’s success. Expert digital consulting becomes crucial in discovering these trends and technological innovations. Hence, it is vital to partner with professionals who understand your requirements and help create an effective plan for the development of your BNPL app.

Step 3. Hiring an Expert App Development Company

Choosing the best mobile app development company is a crucial decision when it comes to building a ‘Buy Now Pay Later’ app. The success of your app largely depends on the proficiency and reliability of the app development company you choose. Choosing a firm with a proven track record and good reputation can ease worries and bring multiple benefits.

For example, a skilled app development company offers a wide range of services all in one place. This holistic approach ensures that you get everything you need, from consultation and design to development and testing, in one location. This integrated service approach simplifies the development process and turns out to be both cost-efficient and time-saving.

Step 4. Designing the App and MVP Development

After you’ve created a solid strategy and hired a proficient mobile app development team, the next critical step is designing your app, taking inspiration from successful platforms like Klarna. This is where the principle of MVP (Minimum Viable Product) development becomes vital.

Using MVP development services allows you to build a simplified version of your app, including only the core features. This strategy lets you test and verify your product with your target audience, collect important user feedback, and make necessary enhancements before developing the full-scale app.

Reviewing the app’s navigation and user interface at this stage offers the flexibility to make changes, significantly cutting down on development and testing time.

Step 5. Development

Start the development process by concentrating on developing the backend framework that underpins essential app features such as payment portals, user account administration, and transaction logs. Emphasize scalability during development to guarantee the app can effortlessly handle an expanding number of users.

Furthermore, integrate the app with one or more trusted payment APIs to allow users to pay for their purchases in installments. This merger must meet stringent security and regulatory standards, providing a secure and compliant environment for financial transactions.

This phase of development sets the groundwork for a sturdy and scalable Buy Now Pay Later app, mirroring the triumphs of industry frontrunners like Klarna.

Step 6. Security and Compliance

The importance of security in the financial sector isn’t hidden from anyone. Considering that your BNPL app has sensitive user data, it needs to be equipped with strong security features and comply with regulatory norms.

Hence, your development company must guarantee the app’s security and compliance, which includes conformity to the Payment Card Industry Data Security Standards (PCI DSS) and the General Data Protection Regulation (GDPR).

Step 7. Testing and Deployment

Performing comprehensive testing is crucial in spotting any bugs or faults in your application. The importance of testing lies in its ability to reveal even the smallest unnoticed errors that might have slipped in during the development process.

Many development companies may consider skipping this phase to cut expenses and speed up the product’s release, but this often results in technical and operational problems that can negatively affect the brand’s reputation.

To address these issues, consider employing testing services for your Buy Now Pay Later (BNPL) application, selecting between manual or automated testing depending on the project’s needs. Once testing is complete, launch your app on app stores.

Step 8. Maintenance

Maintenance is a vital process that guarantees the long-term performance of your Buy Now Pay Later (BNPL) application. By keeping up with the most recent developments in the field through adequate maintenance and support services, you can draw in more users and achieve higher ratings worldwide.

Maintenance and support services usually include improvements to the user interface and user experience (UI/UX), testing, feature updates, technology transition, integration with cloud services, and more.

Hence, it’s crucial to choose a mobile app development company that provides comprehensive services for the continuous success of your BNPL application.

How Much Does It Cost to Develop a BNPL App Like Klarna?

The cost to develop a BNPL app like Klarna UK varies depending on various factors. Remember, to expect a fully functional app like Klarna demands a significant investment, so plan your budget accordingly. At the same time, the factors that affect the overall cost of BNPL app development include

- App’s features

- App Design

- Cost of the Development Team

- Project Magnitude and Complexity

- Technology Stack

- Number of Project Members

- Project Duration

The major contributor to the overall development cost is the hourly rate of developers. It varies depending on their location. For instance, if you hire mobile app developers in India, the cost of developing a BNPL app would be around $40,000-70,000. But if you go with the US developers, the cost will significantly be increased to $150,000-300,000.

Additionally, it is approximately $90,000-250,000 in the UK. The variation in cost is due to the cost of living standards in different regions. You should consider the cost factor while hiring a mobile app developer or a development company for your project.

Conclusion

The rising trend of Buy Now Pay Later (BNPL) apps is fueled by the growing inclination towards online shopping and the desire for adaptable payment options. Investing in BNPL app development could be a profitable venture for business-minded individuals and emerging companies. Nonetheless, it’s crucial to conduct a comprehensive evaluation of market trends and competition before investing substantial resources into app creation.

Given the variations in regulations across different nations and governments, ensuring adherence to relevant laws and consumer protection acts is essential. Developing an app like Klarna requires proficiency in software development, payment systems, and security measures. If these skills are not your cup of tea, hiring a professional development team could be beneficial.

Looking to develop an app like Klarna? Trust Mtoag Technologies as your app development partner. As an experienced app development company, we possess a wealth of knowledge in developing fintech apps similar to Klarna.