How to Develop a FinTech App Like Monzo?

Gone are the days when you had to visit banks, stand in long queues, and wait for your turn; doing so eats up your whole day. However, the emergence of FinTech apps like Monzo has revolutionized the entire banking industry and the way people do financial transactions. The UK banking industry has witnessed an upward trend in the adoption of mobile internet banking apps.

FinTech apps like Monzo offer a high level of convenience, allowing users to open bank accounts, access them, and even make transactions from the comfort of their homes, which wasn’t possible with traditional banking systems. No one can deny that FinTech innovations have drastically changed our lives. The 21st century isn’t about standing in queues to make financial transactions or pay bills.

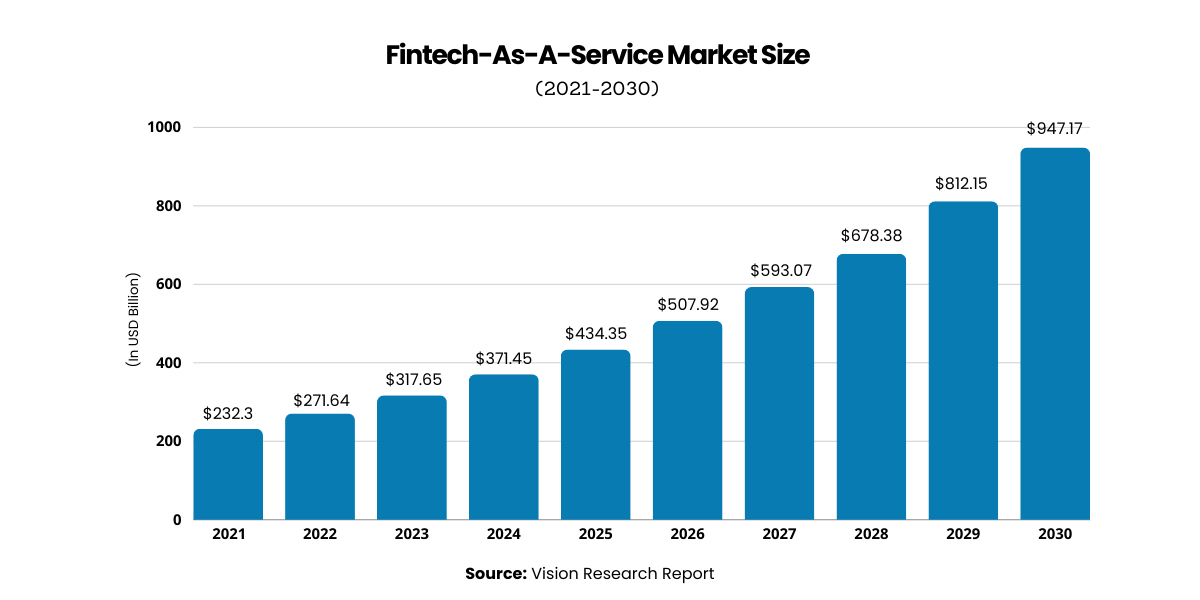

According to the latest report by Statista:

- The global FinTech industry was valued at $317 billion in 2023 and is expected to reach $949.7 billion by 2030.

- The number of mobile banking users in the US has increased to 57 million.

- Over 86% of people globally prefer using mobile banking apps to pay bills and access other services.

Undoubtedly, Fintech apps like Monzo are flourishing and receiving a great response all over the globe. And if you have an app development concept similar to the Monzo mobile banking app, we believe it is high time to invest in it. But if you are struck between how, when, and why to opt for Fintech app development, this comprehensive guide is all you need. In this write-up, we will cover everything from understanding the basics of Monzo and the key features to be integrated into it to the step-by-step process of building Fintech apps and the estimated cost of such projects.

So, let’s get started!

What Exactly is the Monzo App?

Monzo is a digital mobile banking app based in the United Kingdom. It is designed to simplify banking through a user-friendly app that offers a range of financial services without traditional physical branches, focusing on ease of use and transparency.

With Monzo, users can manage their money and track spending in real time, set budgets, and save money with various savings pots. The app also provides instant notifications for transactions, the ability to freeze a lost card instantly, and no fees for spending abroad.

The company’s vision to make banking accessible, convenient, and tailored to modern lifestyles is evident in its offering of advanced mobile apps. It stands out with its vibrant community and customer-centric approach, offering features that align with the needs of tech-savvy consumers seeking control over their financial health.

An Overview of Monzo Business Models

Monzo’s innovative approach to banking is centered on delivering a streamlined and transparent financial management experience via its mobile app.

Here’s an overview of its business strategy:

- Competitive Pricing: Monzo stands out by offering basic financial services at low or no cost, including card transactions and cash withdrawals, making it an economical choice compared to conventional banking institutions.

- Subscription Services: With its Monzo Plus and Monzo Premium options, Monzo introduces tiered subscription services that offer subscribers a range of extra perks and features for a fixed monthly charge, contributing to a varied revenue model.

- Interchange Fees: Monzo earns from merchant transaction fees when customers use their cards for purchases. These interchange fees are set at more competitive rates than those of traditional banks.

- Partnership and Integration: By forming strategic partnerships with external service providers in areas such as savings, investments, and insurance, Monzo not only earns commission through referrals but also significantly enriches its offerings to customers.

Is It Profitable to Develop a Mobile Banking App like Monzo?

Before investing all your hard-earned money into Fintech app development, it is crucial to consider whether it will be a profitable venture. Monzo’s huge popularity is a prime example of how profitable mobile banking app development can be. But that’s not the only reason; here are some of the most prominent ones:

Enhancing Customer Reach

A banking app serves as a gateway to engage with a broader audience. It addresses the specific needs of your business clients while offering an innovative fintech solution to new customers right from the start.

By developing an app dedicated to mobile banking, you break free from geographical constraints, ensuring that all financial transactions can be seamlessly conducted through the app. For example, Monzo has impressively garnered over 2.6 million active users.

In-depth Customer Insights

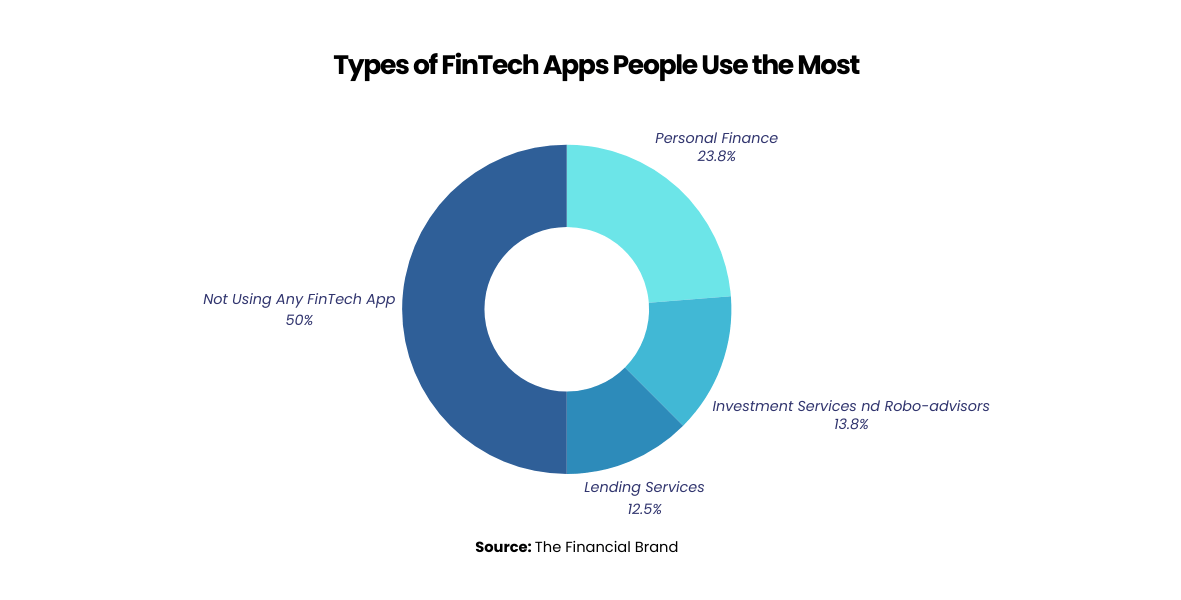

Knowledge is a powerful asset for any business; in the digital world, it’s more accessible than ever. With these apps, you can easily get insights into what types of fintech apps users are using the most. Additionally, every action a user takes within an app—be it loan repayments, deposits, purchases, or travel activities—is recorded. This data is invaluable for devising new marketing strategies and driving sales growth.

Furthermore, this information can be analyzed to understand customer behavior and make business predictions, such as automatically adjusting a user’s credit card limit based on their activity or predicting next month’s number of fund transfers using historical data.

Quick Transactions and Transparency

Every transaction made through a FinTech app is processed instantly, updating account balances within moments. Users can easily track their expenses and review their financial goals. This instantaneity fosters a sense of accountability and transparency between the online banking service and its customers.

Enhanced Security Measures

The exclusivity of banking apps makes them potential targets for cyberattacks. Therefore, banks must implement robust security measures to safeguard user data against theft and hacking attempts, ensuring the privacy and integrity of customer information.

Streamlined Banking Operations

Traditional banking methods often involve time-consuming processes and are prone to human error. Online banking streamlines operations, enhancing accuracy and expediting services.

While developing FinTech apps like Monzo has numerous advantages, it also has challenges that need consideration. Without further ado, let’s take a look at these challenges briefly.

What are the Challenges in Developing a Fintech App?

In today’s evolving economic landscape, awareness of its boundaries and challenges is crucial. Developing a mobile banking app like Monzo is a milestone filled with numerous, often clear-cut challenges.

- Distinct Regulatory Compliance: Digital banks operate under specific regulatory frameworks that vary by region. For example, the UK has its Open Banking initiative, while the EU enforces GDPR.

- Security Concerns: Security is probably the most significant aspect of a digital bank’s integrity. Overcoming this challenge requires a seasoned development team dedicated to implementing robust security measures.

- Handling High Traffic: A banking app must seamlessly manage thousands of transactions and interactions. Crafting an app capable of such features demands exceptional technical expertise.

- Third-Party Dependencies: A digital bank relies on external partners for certain services. Establishing partnerships with entities like MasterCard, Amazon Web Services, or Intercom and nurturing those relationships can be tricky, not to mention the additional security considerations they introduce.

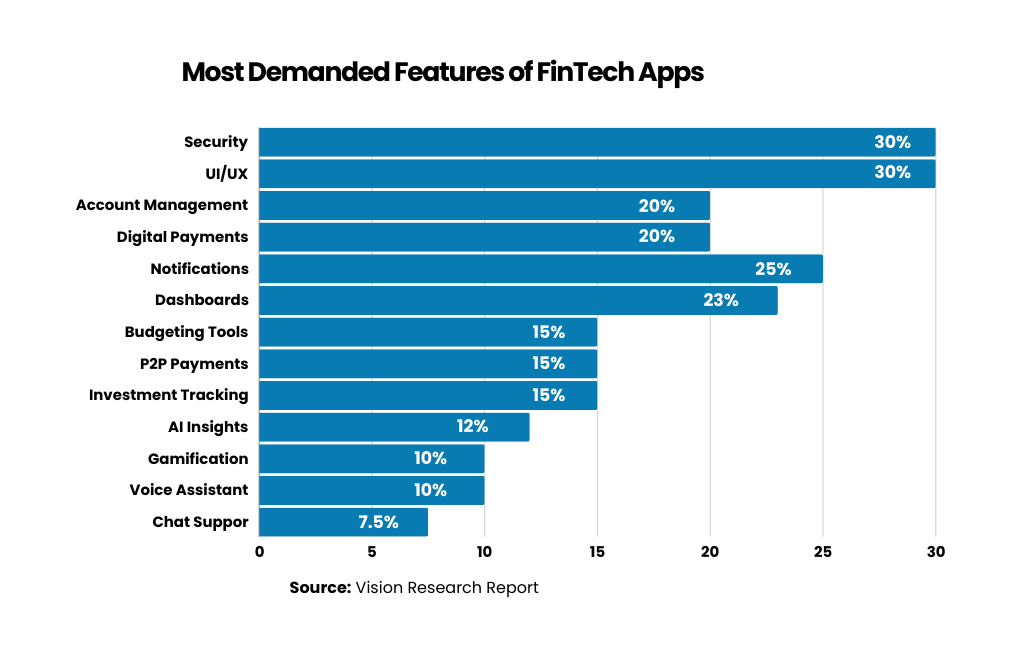

Essential Features to be Integrated in Fintech App Development

Having understood all the benefits of challenges in FinTech development, you might have made up your mind.

So, if you’re ready to develop your own Fintech app, here are some core features and functionalities it should have:

- Robust Sign-In Measures: Integrate multi-layered authentication methods. Combine biometric checks (such as fingerprint scans and facial recognition) with traditional login steps, including passwords and one-time passcodes. Utilize secure frameworks like OAuth to manage user permissions effectively.

- Streamlined User Experience: Create an interface that’s both intuitive and straightforward, featuring clear labels and a sleek design. Equip the platform with functionalities for swift balance inquiries, effortless money transfers, and comprehensive transaction logs.

- Transaction Protection: Secure data transmission with robust end-to-end encryption. Deploy advanced fraud detection systems, leveraging algorithms that spot irregularities and protocols that confirm transaction legitimacy.

- Account Management: Provide extensive tools for account oversight, such as real-time balance updates, statement retrieval, bill settlements, and activity tracking. Empower users with customizable alerts for various account actions.

- Payment Gateway Integration: Integrate your mobile app with trusted payment gateways to support smooth financial operations such as direct user-to-user payments, bill settlements, and retail purchases. Adhere to financial safety standards such as PCI DSS.

- Personal Financial Management (PFM) Tools: Prioritize offering resources for budget creation, expenditure monitoring, and setting financial objectives. Allow transaction categorization, spending trend analysis, and provide insights to foster smarter economic decisions.

- Customer Assistance: Establish multiple support channels, including live messaging, email correspondence, and telephonic help. Introduce an automated chatbot to immediately respond to frequent inquiries and ensure swift resolution of issues.

- Insightful Data Utilization and Reports: Apply data analytics to extract valuable insights on customer habits, preferences, and market trends. Produce detailed reports on activities, transaction behaviors, and fiscal health. Utilize this information to refine services and customize user recommendations.

Steps to Develop a Fintech App Like Monzo

If you have scrolled down to this section, the chances are that you’re very excited about developing an app like Monzo. While every mobile app development company has its own set of procedures, we have listed down the typical process that literally every development team follows. So, here’s the complete process for FinTech app development:

1. Start with In-depth Market Analysis

The first step to developing a successful FinTech app is to do in-depth research. This involves understanding your competition, validating the demand for your proposed solution, and tapping into the pulse of consumer trends.

Skipping this step could lead your failure. Persist in pinpointing your demographic based on the research findings. Your audience could include businesses, families, individuals, and non-profits. A deep understanding of your potential users is pivotal for pinpointing pain points, which is essential for sketching out an app’s blueprint.

2. Sketch Out Your App’s Blueprint

Every financial or banking app starts as a concept. To bring this concept to life, you must draft a visual representation outlining the layout and organization of design elements, visuals, and content in a basic form. Begin with basic wireframes to map out navigation menus, user profiles, personalized dashboards, and home page layouts.

Wireframes are typically composed of simple shapes and text and are rendered in black and white. Utilize these wireframes to validate your concept and solicit preliminary feedback.

You can then elevate your wireframes to high-fidelity prototypes that showcase detailed design elements like imagery, typography, user interface components, color schemes, and micro-interactions. Incorporate dummy text, placeholders, and sample data to give users a hint of the app’s functionality.

3. Create a Graphic Layout

This phase demands meticulous attention as your app’s visual identity serves as its calling card. Creating a visually appealing and working mobile app involves numerous best practices. We have curated a list of critical design considerations for you. Find them outlined below.

- Your app’s typography, icons, color palette, buttons, and forms should be in harmony with your brand identity.

- The navigation should intuitively align with the logical structure of your solution.

- Design elements must be precise and user-friendly: buttons, links, shapes, and icons.

- Choose colors, images, and videos that evoke the desired emotions and sentiments. If your app has a global reach, be mindful of cultural nuances.

4. Specify App Features and Functionalities

The right features and functionalities are crucial for an app’s success. In the table below, we’ve highlighted essential features and some advanced functionalities that you might consider for developing a mobile banking app like Monzo.

|

Features |

Sub-Features |

|

Basic Features |

Fund Transfer. Split Bills. Early payments. Wallet Loans Credits Payment Reminder. Salary sort Overdraft. Payment History Saving tracker Fine/Taxes Donations Add Accounts |

|

Advanced Features |

Chatbot Push notifications. Cashback. QR payments. Trading and investments. Loan checker. EMI calculator. Multi-factor Authentication. Phone call verification. Biometric verification. OTP verification. End-to-End Encryption. Touch Heatmaps. Money management. Budgeting tools |

5. Select the Right Tech Stack

When it comes to choosing the right tech stack for a banking app like Monzo, it is crucial to focus on four key areas: Front-end, Back-end, Cross-platform, and Security. Here’s a checklist with all these parameters included in it:

- Project scope

- Simplicity and complexity.

- Documents and specifications.

We have listed some of the best and most advanced technology stacks for developing a robust Fintech app like Monzo. Let’s have a look:

- For Android – Java, Kotlin, Node JS, ROR, Laravel.

- For iOS – Swift, Node JS, ROR, Laravel, Fabric iOS.

- Database – MySQL, MongoDB, Redis

- Cloud – AWS, MS Azure.

- Push notifications – Twilio, Amazon SNS, MAP

- Other – RSpec, Phantom JS, PUMA server, PhoneGap, C++, Xcode

To succeed in the competitive world of app development, merely defining your app’s features or selecting an advanced technology stack is not enough. You also need a dedicated development team capable of bringing your vision to life.

To ensure your FinTech app stands out from its competitors, you will need a team of professionals –

- A Front-end Developer to craft the user interface.

- A Back-end Developer to manage the server-side operations.

- Android/iOS Developers for creating a cross-platform experience.

- A QA Engineer to ensure the app’s quality and performance.

- A Business Analyst to align your app’s capabilities with market needs.

- A UI/UX Designer for an intuitive and engaging design.

- A Product Manager to oversee the project from conception to launch.

6. Launch Your App

To list your app on Google Play Market, App Store, and Microsoft Store, you must adhere to each store’s specific requirements to prevent rejection.

Choosing an app developer can guarantee compliance with these standards. If you’re developing independently, keep track of these criteria to streamline future updates.

7. Get Feedback and Make Improvements

After launch, actively seek feedback from users and tech influencers to identify areas for improvement. For Apple-centric apps, consider submitting your app for expert analysis by Apple’s editorial team. Additionally, featuring your app in ‘Best Apps’ lists or mobile app awards can provide valuable exposure.

With user feedback, you can pinpoint your app’s strengths and weaknesses, which can guide you in enhancing its functionality and user experience.

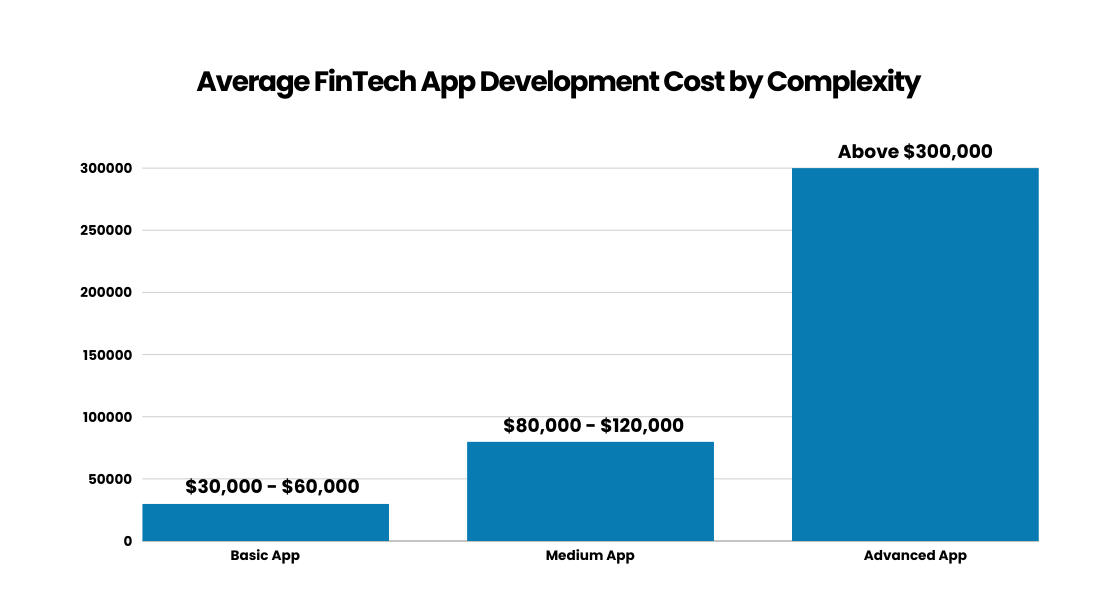

How Much Does It Cost to Develop an App Like Monzo?

Having understood the essential features, technological framework, and key development stages, let’s talk about the most crucial aspect – the cost to develop an app like Monzo.

The cost of mobile app development is influenced by many factors, such as the app’s functionality, complexity, chosen platforms, and the development team’s location. Generally, an app with basic features may cost approximately $35,000 to $65,000. Conversely, more sophisticated apps with advanced functionalities could cost between $80,000 and $135,000.

Expert advice suggests that collaborating with a seasoned development agency ensures your app is robust and compliant with the regulatory standards of the target region.

At Mtoag Technologies, our development process is segmented into distinct phases:

- Discovery: This initial phase involves an in-depth business analysis to ascertain the app’s operational mechanics, user capabilities, and any necessary integrations with external applications. The deliverables from this phase include detailed user flows, diagrams, wireframes, and prototypes.

- Design: In this phase, we create the customer experience design drawing from insights gathered during exploration. This ensures all business objectives and user requirements are met simultaneously. We then proceed to create a visually appealing user interface for the app. The outputs here are implementation-ready wireframes, high-fidelity designs, and a comprehensive style guide.

- Web Development: A mobile application often requires a web-based administrative dashboard for management purposes. The outcome is a fully operational backend office that enables seamless mobile app management.

- Mobile Development: We build an APO (Advanced Planner and Optimizer) to facilitate communication with the server-side application and integrate all components, such as API, architecture, and functionalities. The result is a fully operational application prepared for launch on various platforms like the Google Play Store and the Apple App Store.

How Long Does It Take to Develop a FinTech App?

The time it takes to develop a robust FinTech app similar to Monzo typically spans around three months. This period includes all critical stages, from conceptual design through development to testing and deployment. Integrating complex functionalities, such as AI-powered insights or intricate social media integrations, might necessitate additional time.

Creating a mobile banking application demands a harmonious fusion of creativity, cutting-edge technology, and adherence to financial regulations. Businesses that adopt a methodical approach and utilize optimal resources can effectively tackle the complexities of app development and forge a banking application that truly engages users.

Conclusion

FinTech app development like Monzo demands meticulous planning, incorporation of cutting-edge features, and strict adherence to industry best practices. Our comprehensive guide equips developers with the necessary tools to thrive in the competitive FinTech arena, enabling them to develop an innovative and user-centric financial application.

The financial world is constantly changing, and developing an app like Monzo requires extensive strategic foresight and leveraging the latest technological advancements. However, Mtoag’s expertise can help you with a tactical blueprint to overcome the challenges and pave the way for the development of pioneering FinTech applications in 2025 and beyond.

FAQs

What Software Does Monzo Use?

Monzo utilizes a modern data stack for analytics, including event data streaming via Kafka and NSQ to BigQuery. They employ dbt for data pipeline creation and Looker for insights.

Is There a Web Version of Monzo?

Monzo offers a basic web interface for emergencies, allowing users to freeze cards and view transactions. However, a full web version is not planned, as Monzo is designed primarily for smartphone use.

What is the Alternative to Monzo?

Alternatives to Monzo include Starling Bank, Revolut, and Wise. These offer various features like real-time updates, budgeting tools, and international transaction capabilities.

Does Monzo Use AI?

Yes, Monzo uses machine learning, a subset of AI, to enhance areas like financial crime prevention and customer service, making their banking services more efficient and user-friendly.

Does Monzo have an API?

Monzo provides an REST API and webhooks for interacting with user accounts, which are designed for developers to create tools and services around the Monzo platform.

Why is Monzo so Successful?

Monzo’s success is attributed to its unique approach to banking, offering convenience, simplicity, and strong community engagement. It stands out for its distinctive coral card and user-friendly app features.